palm beach county business tax receipt appointment

A copy stays with the Village of Royal Palm Beach. Palm Beach County Office of Equal Business Opportunity OEBO 50 South Military Trail Suite 202 West Palm Beach FL 33415 PH.

For all questions related to a Palm Beach County CARES Act program payment please see CARES Act Payments.

. Please contact the BTR Division at 561-642-2053 or Businessinfogreenacresflgov to verify if any other documents are required. I certify that I am eligible to apply for this Business Tax Receipt and. Schedule your driver license appointment up to 60 days in advance.

Delinquent local business taxes are payable online and subject to a delinquency penalty of 10 for the month of October plus an additional 5 penalty for each month of delinquency thereafter. Complete the top portion of the Application For a Palm Beach County Local Business Tax Receipt and receive sign off by the Royal Palm Beach Planning and Zoning Department. We will mail your Business Tax Receipt or you may pick it up once approved.

Clients moving to Palm Beach County who are establishing residency are considered Palm Beach County residents. One of our offices most important duties is providing clear concise and transparent information about County revenue and spending. Schedule your driver license appointment up to 60 days in advance.

The address on your local business tax receipt must match the physical address you are registering with our ofifce. The local County Tax Collectors Office is located at. Royal Palm Beach FL 33411.

Palm Beach FL 33480. 360 South County Road. Return the original form to the Tax Collectors Office to obtain a Business Tax Receipt for Palm Beach County.

I hereby apply for a Home Based Business Tax Receipt to use a business telephone listing business stationery and conduct minor business activity of a business office at my residence. We also recommend clients bring an umbrella and water. Monday - Friday 8 am.

Location Ownership Legal Business Name Dba Name Applicant. October 1 10 penalty November 1 15 penalty December 1 20 penalty 1000 collection fee January 1 25 penalty 1000 collection fee. Your Business Tax Receipt is issued subject to Palm Beach Gardens Code Section 78-159 1.

Make an appointment at one of our service centers to process your completed application. Village Hall 1050 Royal Palm Beach Blvd. Arrive Early Please arrive 10 15 minutes before your scheduled appointment.

Box 3353 West Palm Beach FL 33402-3353. Hours Monday - Friday 800 am - 500 pm. We can only service one person per appointment.

200 Civic Center Way Royal Palm Beach FL 33411 Map. Dont wait until the last minute. The Village will mail the North Palm Beach Business Tax Receipt to the business shortly thereafter including the approved Palm Beach County application You may then go to the county tax collectors office for payment and processing of the county application Residential Locations Only Residential locations are required to submit the following.

Royal Palm Beach FL 33411. They must schedule their own individual appointment. Can I pay for a new Business Tax Receipt application online.

This requirement includes one-person and home-based businesses. For questions about an invoice you received please call 561 355-3643. Business tax is regulated by Florida Statute Chapter 205 as well as City.

Directory Quick Links FDS - Fictitious Name Registration PB County Business Tax Receipt Online Renewals. YOU WILL BE CONTACTED VIA EMAIL WITH NEXT STEPS AND PAYMENT OPTIONS. Complete the Business Tax Receipt form which can be obtained at the Tax Collectors Office or in the Zoning Division lobby located the second floor at 2300 North Jog Road West Palm Beach FL.

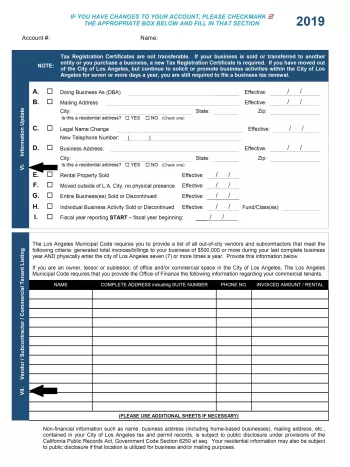

Hours Monday - Friday 800 am - 500 pm. All redemptions must be done at the tax collectors office 301 north olive ave third floor west palm beach. APPLICATION FOR PALM BEACH LOCAL BUSINESS TAX RECEIPT __ NEW Business Tax Receipt __ CHANGETRANSFER Circle.

Application Requirement Guide for Local Business Tax Receipt Unincorporated Home Based Business - No zoning approval required. Inspection Scheduling Hours Monday - Friday 8 am. All new applicants must be processed in City Hall.

Currently the online payments are only accepted when renewing the annual BTR. You may contact the office at 5616166840 to schedule an appointment. Business tax is a tax you pay to the City for the privilege of doing business in the City.

You are required to complete the correct application see Forms pay fees and in most cases have inspections in order to comply and be issued a local business tax receipt formerly known as occupational license. Click Here to Schedule Requirements for making an appointment. PO Box 2029.

Palm Beach County Business Tax Receipt Appointment at Tax. The Zoning Public Information Planner will review the request and verify the zoning district and whether the use is allowed for that specific location. This also applies to spouses and domestic partners.

Village Hall 1050 Royal Palm Beach Blvd. Local Business Tax Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. Tourist Development Tax strengthens our local economy by supporting Palm Beach Countys tourism industry.

8719 business tax email address business tax email address. Failure to have a current palm beach county local business tax receipt will result in the disapproval of your license application until such time that a palm beach county local business tax receipt is obtained. Palm Beach County Residents Schedule your appointment today.

Town of Palm Beach.

Top Notch Movers Is A Professional Moving Company In Fort Lauderdale We Move Miami Dade Broward And Palm Beach Counties Broward Business Tax Moving Company

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Business Tax And Regulations Btr Division Hallandale Beach Fl Official Website

Fill Free Fillable Constitutional Tax Collector Pdf Forms

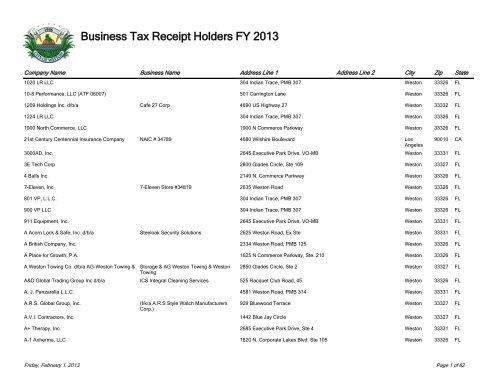

Business Tax Receipt Holders Fy 2013 City Of Weston

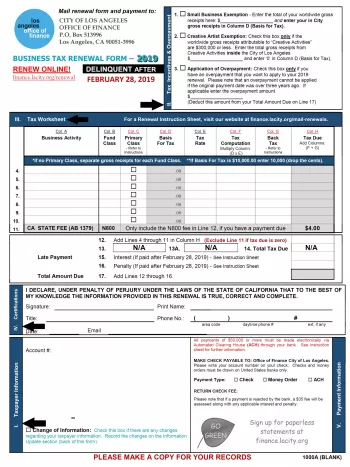

Business Tax Renewal Instructions Los Angeles Office Of Finance

Business Tax Receipts Citrus County Tax Collector

Fill Free Fillable Constitutional Tax Collector Pdf Forms

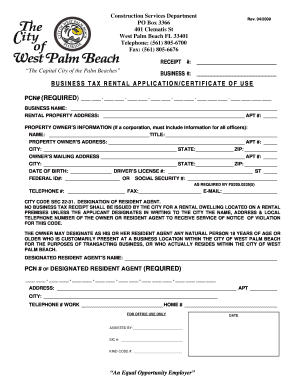

City Of West Palm Beach Business Tax Fill Out And Sign Printable Pdf Template Signnow

Tourist Development Tax Constitutional Tax Collector

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Local Business Tax Constitutional Tax Collector

County Business Tax Receipt Renewals Start July 1st

Business Tax Renewal Instructions Los Angeles Office Of Finance